Stocks

Crypto

Indexes

Forex

Metals

Oil

TRADING TECHNOLOGY

BOTS, TRADE COPIERS, INDICATORS+

futures / stocks

#1 fully automated trading BOTS

FULLY-AUTOMATED | PROBABILITIES | FUTURES / STOCKS

Learn automated bot trading and everything you need to set up, backtest, deploy, optimize, review and GO LIVE with fully automated trading bots. Go from a total newbie to an experienced bot trader and run multiple bot strategies on your desktop or in the cloud.

NOTE: You do NOT need to know how to write code.

AVAILABLE in our PREMIUM COMMUNITY

ORB BOT

FULLY-AUTOMATED | TRENDING | PROBABILITIES

SNAPBACK BOT

FULLY-AUTOMATED | REVERSAL | PROBABILITIES

VOLUME BOT

FULLY-AUTOMATED | REVERSAL | TRENDING

NR7 BOT

FULLY-AUTOMATED | TRENDING | PROBABILITIES

10EMA BOT

FULLY-AUTOMATED | TRENDING | PROBABILITIES

MEGA ORB BOT

FULLY-AUTOMATED | TRENDING | TECHNICAL ANALYSIS

MEGA SNAPBACK BOT

FULLY-AUTOMATED | TRENDING | TECHNICAL ANALYSIS

MEGA SCALPER BOT

FULLY-AUTOMATED | TRENDING | TECHNICAL ANALYSIS

Our trading bot technology is only available with our jump start program.

TRADING TECHNOLOGY

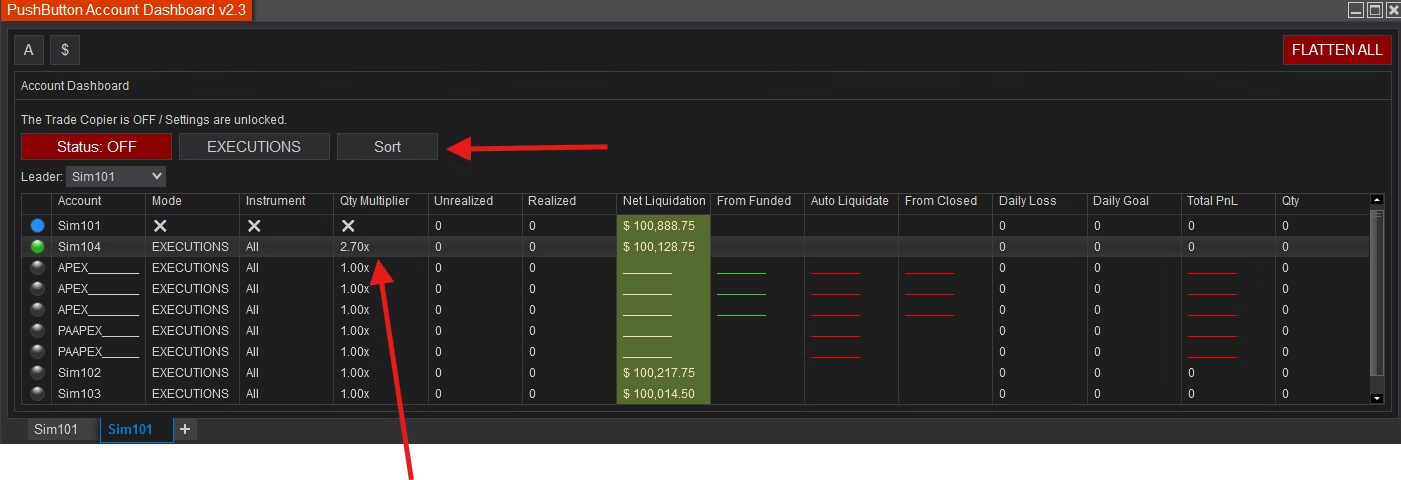

#2 ACCOUNT DASHBOARD AND TRADE COPIER

Introducing our powerful Account Dashboard/Trade Copier. While similar tools can cost hundreds or even thousands elsewhere, we are offering this advanced tool to help streamline your trading experience.

With the Account Dashboard/Trade Copier, you can seamlessly copy market orders or exact orders across unlimited accounts, whether you're trading with funded accounts, personal accounts, or simulated accounts. It also features robust built-in risk management, automatically stopping trades under specific conditions to protect your capital.

Stay on top of your trading performance with key insights at a glance, such as account balances, distance to becoming fully funded, or the risk of closing out your account. It's designed to help you stay informed and in control—no matter how many accounts you manage.

If you're looking for a comprehensive trading toolset, our premium membership offers incredible value with features that keep you ahead of the game.

FEATURES INCLUDE

Copy trades to unlimited / multiple accounts.

Copy trades with "execution" mode (market orders with every executed order on the leader) or "orders" mode (duplicate exact order types to each account).

Customize Quantity to copy to follower.

Optional to copy only trades made on specific symbols, anything else traded on the leader doesn't copy to the follower.

See open P&L , Realized Gains, Total P&L, Open Qty, and more for every account .

Set a daily loss and daily goal as a global setting or a custom setting per account that stops trading if reached.

For funded accounts, view your amount until funded, amount till breached, and auto liquidation levels at a glance.

Set threshold limits to exit trades, lock in profit and stop trading on accounts that have reached the funded goal.

Built in logic to recognize if orders are entry or exit orders and will not place opposite orders on followers that failed to enter a prior trade to prevent stray orders.

Hide/show sensitive information such as live/prop firm account name, balance, etc.

Instantly close all open orders and open positions with a single FLATTEN ALL button.

Our account dashboard and trade copier are only available when bundled with our jump start program.

TRADING TECHNOLOGY

#3 TRADING INDICATORS

VOLUME WEIGHTED AVERAGE PRICE / VWAP

Our premium membership includes a built-in VWAP (Volume Weighted Average Price) indicator for NinjaTrader, without the need for the order flow subscription. This tool helps you analyze market trends and make informed decisions, all at no extra cost with your premium membership.

VOLUME PROFILE INDICATOR

Our premium membership includes access to our custom-built Volume Profile indicator, typically available only through NinjaTrader’s order flow subscription. With us, you don’t need the addon—gain insights into support and resistance zones, all at no extra cost with your premium membership.

CANDLE FINDER

INDICATOR

Our Candle Finder indicator, highlights key patterns like hammers, indecision, and inside candles, making it easier to spot potential setups w hich enhances your ability to make faster, informed decisions within NinjaTrader, giving you an edge in the market, all at no extra cost with your premium membership.

Our trading indicators are only available when bundled with our premium community.

© 2025 by Push Button Trading, All Rights Reserved

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonial Disclosure:

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Educational Disclosure:

The Push Button Trading mentorships, courses, classes, live events, and content are provided for educational purposes only. We are not providing financial advice. It is your responsibility to test all strategies and plans. You are the only one pushing the buttons and it is your responsibility to fully understand the risks before implementing any of the education provided by Push Button Trading.

Frequently asked questions

What are the rules for the assessment account?

It's crucial to understand the distinction between "Hard Breaches" and "Soft Breaches".

Hard Breach refers to a strict rule that, if violated, will result in immediate account termination.

Soft Breach refers to a guideline that, if violated, will result in an immediate close of an incorrectly placed trade and a warning email.

HARD BREACH RULES:

1. Achieve a profit target of 10% to qualify for funding.

2. Do NOT lose more than 5% in any single day (24-hour period).

3. Do NOT lose more than 6% of your account based on your high water mark which starts at your initial balance.

4. Inactivity within a 30-Day period will result in hard breach of the account. At least one trade must be executed per 30-day period.

5. All positions MUST be closed by 3:50pm EST on the day of an Earnings Release OR the previous day.

SOFT BREACH RULES:

1. All trades MUST have a stop loss. Trades placed without a stop loss will result in an immediate close of the position.

2. All trades MUST be closed by 3:45pm EST on Friday, unless "Trade Over Weekend" option has been selected at time of purchase.

3. There is a Max Lot Size allowed for each trade. Failure to follow this will result in the closure or non-execution of your trade.

What are the rules for the Live Account?

The rules for the Live Account are exactly the same as your Assessment account. However, with a Live Account, there is no account growth target.

How do I withdraw the gains in my Live Account?

1. In order to withdraw funds, you MUST have passed the Audition Phase and be trading in a live FUNDED account.

2. Your INITIAL withdrawal can be requested at any time.

3. Additional withdrawal requests can be made ONCE EVERY 30 DAYS.

4. Withdrawal requests are made by logging into your dashboard and submitting a request to withdraw funds through the Profit Share tab along the left toolbar.

5. NOTE: First withdrawal will AUTOMATICALLY LOCK YOUR TRAILING DRAWDOWN TO YOUR STARTING BALANCE.

What happens if I BREACH an account?

If it's a HARD BREACH the account will no longer function. You will be required to purchase another one-time audition and start the process again. If it's a SOFT BREACH, you'll receive an email notifying you of the breach, most likely any position opened resulting in the soft breach will be closed immediately.

What times can I trade in the Funded Account?

There are various assets that have different trading times. Most assets are open for trading from 9:31am EST to 3:55pm EST Monday to Thursday, and 9:31am EST to 3:45pm EST on Friday.

Crypto is open for trading 24-hours per day.

Forex & Futures are open for trading from Sunday 6pm EST to Friday 3:45pm EST.

To hold trades over the weekend OR to trade Crypto on the weekend, "Trade Over Weekend" option must be added to your account at the time of purchase.

How do you calculate the 5% Daily Loss Limit?

The Daily Loss Limit is the maximum your account can lose in any given day. Daily Loss Limit is calculated using the previous day balance which resets at 5 PM EST. Unlike other firms, we do NOT base our calculations on previous day equity since the balance only model allows you to scale your gains without fear of losing your account. The Daily Stop compounds with the increase in your account. Example: if your prior day's end of day balance (5pm EST) was $100,000, your account would violate the daily stop loss limit if your equity reached $95,000 during the day. If your floating equity is +$5,000 on a $100,000 account, your new- day (5pm EST) max loss is based on your balance from the previous day ($100,000). So, your daily loss limit would still be $95,000.

What instruments can be traded?

The funded accounts trades CFD's (Contract for Difference). These are derivative products that track an underlying asset (Stocks, Forex, Futures, & Crypto). There are currently 1177 different CFD's available to trade spread across all the underlying assets.

How do you calculate the 6% Maximum Trailing Drawdown?

The Maximum Trailing Drawdown is initially set at 6% and trails (using CLOSED BALANCE - NOT equity) your account until you have achieved a 6% return in your account. Once you have achieved a 6% return the Maximum Trailing Drawdown no longer trails and is permanently locked in at your starting balance. This allows for more trading flexibility. Example: If your starting balance is $100,000, you can drawdown to $94,000 before you would violate the Maximum Trailing Drawdown rule. Then for example let's say you take your account to $102,000 in CLOSED BALANCE. This is your new high-water mark, which would mean your new Maximum Trailing Drawdown would be $96,000. Next, let's say you take your account to $106,000 in CLOSED BALANCE, which would be your new high-water mark. At this point your Maximum Trailing Drawdown would be locked in at your starting balance of $100,000. So, regardless of how high your account goes, you would only breach this rule if your account drew back down to $100,000 (note, you can still violate the daily drawdown). For example, if you take your account to $170,000, as long as you do not drawdown more than 5% in any given day, you would only breach if your account equity reaches $100,000.

Will I be trading REAL money?

There are TWO phases to the funded account program. PHASE ONE is your audition phase. In this phase you will be trading a paper account. This is NOT real money. The intent of this phase is for you to prove you have the skills to trade the account in a responsible manner while becoming profitable without violating the account rules. PHASE TWO is the funded phase. In this phase you have proven yourself as a capable trader and have now been given the access to investor backed funds. Your account will now be trading with REAL money. The same rules apply in both phases. Withdrawals are ONLY available in the funded phase.

What is the minimum age I must be to be part of your program?

You must be at least 18 years of age, or the applicable minimum legal age in your country, to purchase an assessment.

What is the leverage?

We allow up to 10:1 leverage. Forex, Metals, and Indices are 10:1. Equity shares are 5:1. Cryptos are 2:1. If the Double Leverage Add-on is purchased, Forex and Metals will be 20:1.

What Countries are accepted?

Subject to compliance with applicable laws and regulations, traders from all countries, excluding OFAC listed countries, can take part in our program.

What are the trading hours?

Trading hours are set by the Broker. We do not have any control over the trading hours. You can see the trading hours for each product by right-clicking on any product in the Market Watch window of the MT4 or MT5 platform and selecting Specifications from the dropdown menu. Please note that holidays can have an impact on available trading hours. Additionally, pursuant to the no holding trades over the weekend rule, we close all open trades at 3:45pm EST on Fridays.

Trader Verification

Before you are issued your Live Account, you will be required to perform KYC via SumSub. We do not store any documents - all documents are sent through the SumSub portal for review. Once verified, you will sign your Trader Agreement and then be issued your Live Account.

How are taxes handled?

When trading a Live Account for our firm, you are treated as an independent contractor. As a result, you are responsible for any and all taxes on your gains.

Do your accounts charge commissions?

We use the RAW accounts from the Broker. These accounts have commission charges for Forex and Equity Share CFDs. The other products do not carry a commission.

Do we manipulate the pricing or executions you receive in your Live Account?

No. We operate at an arm's length with the Broker. All market pricing and trade executions are provided by the Broker and are not changed or modified by us. Additionally, we do not mark up transaction costs established by the Broker through adjusting bid-offer spreads, markups/markdowns, commission charges or swaps.

Can I trade during News Events?

Yes, you can trade during the news provided that pricing data from the Broker continue to be provided.

Can I hold positions over the weekend?

We require all trades to be closed by 3:45pm EST on Friday. Any trades left open after this time will automatically be closed. Note, this is only a soft breach and you will be able to continue trading once the markets reopen.

Am I subject to any position limits?

We reserve the right to limit the number of open positions you may enter or maintain in the Live Account at any time, and to revise in response to market conditions the drawdown levels at which trading in the Live Account will be halted. We or the Broker reserve the right to refuse to accept any order.